While many Americans saw their energy bills go up substantially in the past year, investor-owned electric and gas utilities and the country’s largest publicly owned utility paid their CEOs over $647 million in 2023, an increase of 9 percent over 2022, an analysis by the Energy and Policy Institute has found.

The CEOs for the 57 companies and the federally-run Tennessee Valley Authority reviewed for this analysis received more than $3 billion in total between 2019 and 2023. During this time, the same utilities disconnected millions of customers for being unable to pay their monthly bills.

Top Earners

Atlanta-based utility Southern Company paid Tom Fanning, who retired as CEO in May last year, $33 million in total compensation, making him the top earner in 2023.

Sempra Energy paid CEO Jeffrey Martin the second-highest compensation, with $27 million, followed by FirstEnergy CEO Brian Tierney, who took home $26 million. PG&E CEO Patricia Poppe rounded out the top ten earners with her $17 million in compensation.

A number of these CEOs appeared in the top earners’ bracket in the previous year as well – some even seeing a pay increase compared to that timeframe. NextEra Energy paid former CEO James Robo $40 million in 2022, making him the highest paid executive. Southern Company paid Fanning $24 million that year. Duke Energy paid Lynn Good $21 million in 2022, and Berkshire Hathaway paid $19 million to Gregory Abel. Sempra paid Jeffrey Martin $18 million.

Utilities disconnect hundreds of thousands of customers for non-payment

While these top earning utility CEOs raked in hundreds of millions of dollars in total last year, their companies disconnected hundreds of thousands of customers who struggled to pay their ever-increasing bills. Data collected and reviewed by EPI from utilities’ reports to regulators show that three of Southern Company’s subsidiaries that are required to report shutoffs – Georgia Power, Atlanta Gas Light, and Nicor Gas Company – disconnected 270,972 residential customers in 2023, the highest number of these utilities.

Duke Energy disconnected the second-highest number of customers last year with 268,871. FirstEnergy recorded the third-highest figure with 217,672 disconnections. PG&E disconnected 181,811 customers, followed by Eversource, which disconnected 49,170 customers. Berkshire Hathaway disconnected 29,870 customers, and Xcel shut off service to 28,922 customers. Sempra Energy’s subsidiaries SoCalGas and SDG&E reported 2,120 disconnections.

Data for NextEra’s Florida Power & Light is unavailable since the Florida Public Service Commission does not require the utilities to report this information.

Utility disconnections have grown into an acute national crisis, according to a recent report from the Center for Biological Diversity and the Energy and Policy Institute. Households had their electric power shut off more than 1.5 million times in the first 10 months of 2022, a 29% increase over the same period in the previous year. In that same period, households were also disconnected from gas more than 380,000 times, a 76% increase over 2021. Utility customers struggling to pay their energy bills to avoid disconnection may accrue debt and forgo other key expenses, like food, research has shown.

Trends in CEO Compensation

Fossil fuel buildout incentives for TVA, clean energy awards unclear

In EPI’s 2020 report that analyzed executive compensation, Ameren, Arizona Public Service, and DTE Energy’s compensation plans stood out for their incentives encouraging executives to maximize the operation and availability of fossil fuel power plants. Each of these utilities no longer has the incentives. Ameren changed its coal availability metric after pressure from the Sierra Club in 2018. APS eliminated its coal metric in 2022. DTE Energy opted not to include its generation availability metric in its 2023 performance objectives.

As these utilities transitioned to align annual incentives with their decarbonization targets, the Tennessee Valley Authority (TVA) continued to provide its executives with fossil fuel availability incentives, despite a goal to achieve net zero emissions by 2050. TVA is owned by the federal government and its board of directors is appointed by the President and confirmed by the Senate. In the past four years, TVA executives have made $3.1 million off of their fossil fuel metrics, according to a report from the Center for Biological Diversity. The report further details how new gas plants may result in CEO Jeff Lyash receiving bonuses of hundreds of thousands of dollars per year.

Several other utilities tie CEO incentives to clean energy targets, but those are often abstract and lack clear metrics. Sempra awarded CEO Jeffrey Martin last year for renewable energy interconnection “requests” to the company’s Oncor transmission system in Texas, but the company does not specify how many of those requests the utility actually connected to the grid. Sempra did not respond to EPI’s request for comment and clarification.

Northwest Natural provided its executives with an annual incentive that included a renewable natural gas (RNG) strategy to “further our efforts to convert what goes through NW Natural’s pipes to renewable energy." While the company does not provide details and specific metrics on how these were achieved and whether the executives met these goals - the CEO reached 145% out of the maximum payout of 175% for this broader performance incentive category - Northwest Natural recently acknowledged that it has not hit its own targets in Oregon for integrating RNG into its pipelines. Furthermore, RNG largely presents a false solution to emissions reductions in the building sector as it is leaky and climate intensive, unavailable at scale, and costly. NW Natural did not respond to EPI’s request for comment and clarification.

In other cases, CEOs were awarded for ostensible clean energy targets that in reality are tied to dirty fuels. Under an “Environmental and Sustainability“ goal, Dominion Energy incentivized its executives for when employees “focused on education about and advocacy for natural gas.” Dominion Energy did not respond to EPI’s request for comment and clarification.

Increasing Return on Equity boosts executive bonuses at customers’ expense

Some utilities included increasing a subsidiary's return on equity (ROE) as a metric among the several financial valuations used to determine total executive compensation. The ROE measures how much a utility is allowed to earn in profits on qualifying capital expenditures, and is determined by state utility regulators during a rate case proceeding. It is a key profit driver for utilities and a cost that customers bear, making it an often hotly contested issue in rate cases. Using the ROE as a financial instrument to reward utility executives likely further motivates the company's advocacy and focus to increase ROE; while other financial metrics, like the utility’s stock performance, can go up without increasing customers’ rates, increases in approved ROE would typically come out of customers’ pockets. Some of the utilities that have ROE-tied incentives include DTE Energy, Exelon, and WEC Energy.

Trevor Lauer, vice chairman and group president for DTE Energy, maxed out his incentive payout for DTE Electric's average ROE. The incentive is based on DTE Electric’s three-year average return on equity, expressed as a percentage, calculated based on operating income. The utility hit the 10.5% target, triggering the maximum payout for Lauer, which was weighted at 40% of his overall incentives.

Similarly, WEC Energy Chairman Gale Klappa and CEO Scott Lauber, and other company executive officers, earn more in compensation when ROE for all the utility's subsidiaries is higher. The company’s annual proxy filing details how executives receive significant payouts based on the weighted average ROE of all WEC Energy subsidiaries, over a three-year period.

WEC Energy subsidiaries filed to increase electric and gas rates for its We Energies, Wisconsin Public Service Corporation, and Wisconsin Gas customers. The utilities have all proposed a 10% ROE. Wisconsin regulators reduced We Energies’ ROE to 9.8% in their December 2022 decision from the requested 10%, but it remains to be seen exactly how the current regulators view ROE.

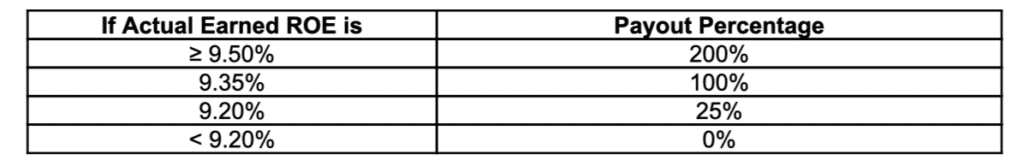

Exelon, the parent company for Atlantic City Electric, Baltimore Gas & Electric, ComEd, Peco, Pepco, Potomac Electric, and Delmarva Power, also rewarded executives based on the earned ROE for its electric and gas companies. The performance scale ranges from 8.1% to 9.9%. The performance for 2021-2023 was 9.3%, which helped contribute to $2.2 million in additional compensation for Exelon President and CEO Calvin Butler Jr.

Excessive or special perks

Utilities continued to provide their CEOs with extraordinary perks and incentives in 2023.

Southern Company allowed CEOs Womack and Fanning personal use of the company aircraft, provided tickets for sporting and other entertainment events, funded spousal expenses related to business travel, and provided gifts distributed to attendees at company-sponsored events.

Dominion allowed CEO Robert Blue to use the company jet for personal travel as well, including with family and guests. Similarly, Sempra’s Jeffrey Martin used the company’s aircraft for personal use, and “on rare occasions,” with family members and guests, while Duke allowed Lynn Good to use the jet for personal travel in North America. CenterPoint “occasionally” provided its aircraft to outgoing CEO David Lesar for personal use.

Along with allowing personal and spousal travel use of corporate aircraft, PSEG provided its executives with club memberships. UGI allowed its executives to use company tickets for sporting events for personal purposes. Similarly, Exelon provided executives personal use of corporate-leased skyboxes for cultural, entertainment, or sporting events, and PPL gave its executives tickets to local sporting and entertainment events.

Notes on the data

This analysis is focused on the compensation paid to the CEOs of 57 investor-owned electric and gas utility companies plus the Tennessee Valley Authority, during the seven year period between 2017 and 2023. It includes the compensation paid only to the CEOs of the parent companies of the investor-owned utilities and TVA; it does not include compensation paid to the CEOs of those companies’ subsidiaries, nor does it include compensation paid to the companies’ other top executives. Aside from TVA, it also does not include compensation paid to the CEOs of non-profit utilities, such as electric cooperatives and municipal utilities.

When utilities had more than one CEO during the seven-year period, we showed compensation for each CEO, which sometimes includes payments to two people in the same year. For incoming CEOs that were promoted from within the company, data for their compensation for their first year as CEO may include compensation they received that year in their earlier position, because corporate filings typically do not distinguish between the compensation they received for each position.

Data are from summary compensation tables published in companies’ 14A proxy statement or 10-K forms, filed with the Securities and Exchange Commission (SEC), or those forms’ equivalents for companies headquartered in countries other than the US.

Figures for CEOs paid in foreign currency were converted into and recorded in the tables in US dollars using the average official rate of exchange between the two currencies for 2023.

EPI included in our analysis nearly all of the investor-owned electric utilities that are members of the Edison Electric Institute (EEI), and investor-owned gas utilities that are represented on the American Gas Association (AGA) board of directors. EEI is the trade association for investor-owned electric utilities in the US, and AGA is the trade association for investor-owned gas utilities in the US; several utility companies (or their subsidiaries) are members of both trade associations. A few EEI and AGA member companies are not included in this analysis, because their ownership structures do not require them to report this data to the SEC.

For the utility disconnections figures, EPI gathered data from states where utilities are required to report shutoffs for non-payment. FirstEnergy’s disconnection totals covered the utility’s operations in Maryland, Pennsylvania, and Ohio. Eversource’s data covered its Massachusetts, Connecticut and New Hampshire service territories. Berkshire Hathaway’s data covered its MidAmerican utility customers in Illinois, Iowa, and South Dakota, and Pacificorp customers in Oregon and Washington. Duke Energy’s figures came from Indiana, North Carolina, South Carolina, and Ohio. Xcel’s data was retrieved from Colorado, Michigan, Minnesota, and North Dakota.

Further Reading

Utility CEOs received $3.2 billion in executive compensation from 2017 – 2022

Utility CEOs received $2.7 billion in executive compensation from 2017 – 2021